We're exhibiting at E-World | Register & Secure your Meeting

Germany, Essen | 11-13 February

Germany, Essen | 11-13 February

24 July 2024

Lili Strege

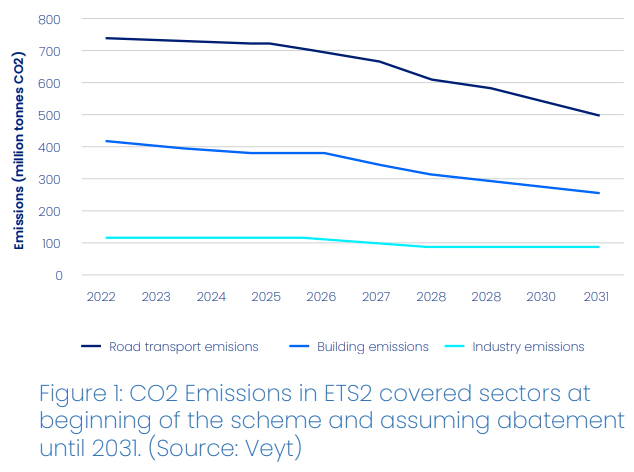

Designed to drive decarbonisation in the private sector, the ETS2 aims to achieve a 42% reduction in fuel emissions by 2030 compared to 2005 levels (see Figure 1). Together with the ETS1, the scheme will cover 71% of the EU’s greenhouse gas emissions.

From January 1, 2025, all operators falling under the ETS2 will require a greenhouse gas emissions permit to operate. The scheme primarily targets fuels used in electricity and heating in buildings and road transport.

Installations previously excluded under ETS1 due to energy thresholds may now be brought under ETS2, expanding the scope of compliance requirements, additionally member states have the option to apply for an extension of the scheme to other sectors on a state-by-state-basis.

Compliance obligations will rest upstream with fuel suppliers, ensuring accountability at the point of fuel release for consumption.

Contact us to find out if your sector will be affected and if you or your fuel supplier have a compliance obligation.

Emissions associated with fuels for that are sold for the relevant purposes will be calculated using default emissions factors.

These factors are based on CO₂ emitted per tonne of petrol, diesel, gas oil, kerosene, LPG, natural gas, heavy fuel oil (HFO), coal, coke, or per megawatt-hour (MWh) of electricity. Where fuels contain a biogenic portion, an additional fossil fraction factor will apply to ensure accurate emissions accounting.

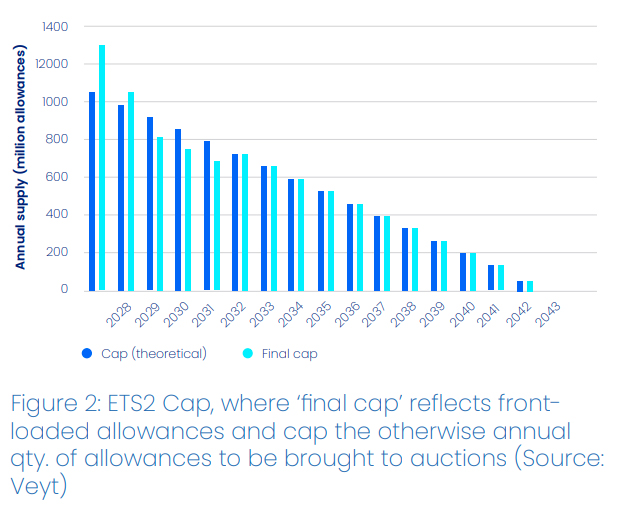

The ETS2 will operate under a cap-and-trade system, with the total number of allowances limited based on the prescribed abatement trajectory. The initial cap for 2027 will be based on 2024 emissions data and adjusted annually using a linear reduction factor (LRF) of 5.10%. From 2028, the LRF will steepen to 5.38%, ensuring progressive tightening of the cap over time.

To prevent early allowance shortages, the EU Commission will front-load 30% of allowances for 2027, drawing from allocations scheduled for 2029–2031. Allowances will be sold exclusively through auctions, as no free allocations are planned under ETS2. Revenue from these auctions will be allocated to climate action and the Social Climate Fund, which aims to support vulnerable households affected by cost pass-through.

The ETS 2 compliance cycle starts from 2025 – see timeline in figure 3. Several key dates will be relevant for the reporting of emissions before the ETS2 launches fully in 2027.

By 31st August 2024

Obligated entities must submit a Monitoring Plan to their Competent Authority (CA), which will serve as the basis for their MRV process starting in 2025.

By 31st December 2024

The Competent Authority will review the Monitoring Plan and recommend any changes.

On 30th April 2025

Submission deadline for report covering 2024 historical emissions (no verification required) – and annual MRV report every year thereafter (must be verified).

Figure 3: Relevant policy dates preceding start of the scheme and compliance cycle post 2027 (or 2028)

A Market Stability Reserve will hold 600 million allowances until 2031, ensuring price and supply stability. Allowances will be released or withdrawn based on predefined thresholds.

Quantity-Triggered Mechanisms

If allowances exceed 440 million, 100 million will be withdrawn.

If allowances fall below 210 million, 100 million will be added.

Price-Triggered Mechanisms

Allowances will be released if prices exceed €45 (adjusted for inflation) for two consecutive months or if average auction prices double or triple within a specified period.

These mechanisms are designed to harmonise with each other and can only release allowances once per 12-month period unless further conditions are met.

As a cap-and-trade scheme, a secondary market for trading of ETS2 allowances is expected to develop. Price discovery will depend on demand and supply dynamics as well as how the market stability mechanisms will operate. The €45 trigger may serve as psychological level and we could see allowances trade at this price when the market gets started. Other dynamics could include any price convergence between ETS1 and ETS2 due to an expectation of a link between the two schemes from 2031.

The EU Commission is currently monitoring transposition of the revised EU ETS Directive into national laws.

Countries with national schemes already covering fuels for buildings and transport, can decide whether to participate in the ETS2 from 2027 or delay until 2030 when it becomes mandatory (the national carbon price must be at least equal the EU ETS2 allowance price in any given year). No EU country has applied for an extension so far.

Countries may also choose to extend ETS2 obligations to fuels sold for other purposes.

Several legal acts fine-tuning the functioning of the scheme are currently underway.

The EU ETS2 represents a transformative expansion of the emissions trading framework, bringing new sectors and operators into compliance. As firms adapt to the complexities of managing carbon allowance purchases, understanding market dynamics and developing a risk management strategy will be crucial. The complexities include carbon price volatility, keeping up to date with policy developments and developing an appropriate risk management strategy to hedge and manage compliance requirements.

CFP Energy has over 15 years of experience in carbon markets, including the EU ETS, UK ETS, and Germany’s nEHS.

Our award-winning team supports operators in navigating policy changes, crafting compliance strategies, and executing trades effectively.

We operate one of the largest trading desks as we specialise in working with ETS operators to help them understand policy, keep up to date with the market, develop a compliance strategy and execute trades effectively.

Contact us today to learn how we can assist your business in the evolving carbon market landscape: Get in Touch

CFP Energy is a leader in carbon, energy and commodity markets, delivering an award-winning compliance service for ETS operators.

We specialise in working with EU ETS operators to understand policy, develop a compliance strategy and execute trades effectively

We provide clients with unique market insights and a full range of carbon trading solutions, as well as innovative products to reduce compliance compliance costs.

CFP Energy is pleased to announce the appointment of Ken Kawase as the new Head of Commercial. Ken brings over 14 years of extensive experience in the energy commodities sector.

CFP Energy is proud to have been recognised in the Environmental Finance Environmental Market Rankings 2025.

CFP Energy is proud to have been recognised in the Environmental Finance Environmental Market Rankings 2025.